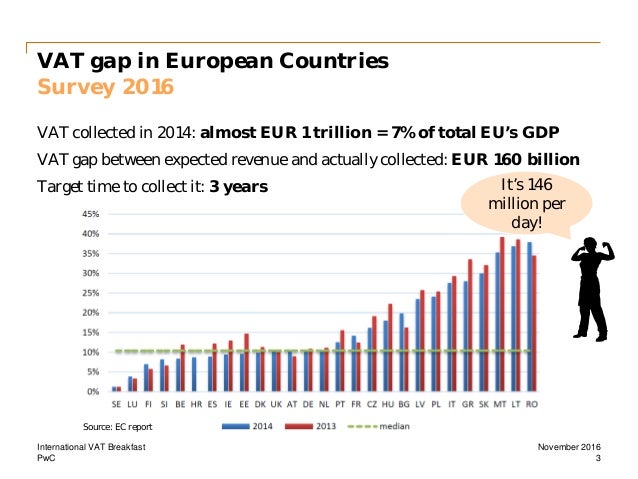

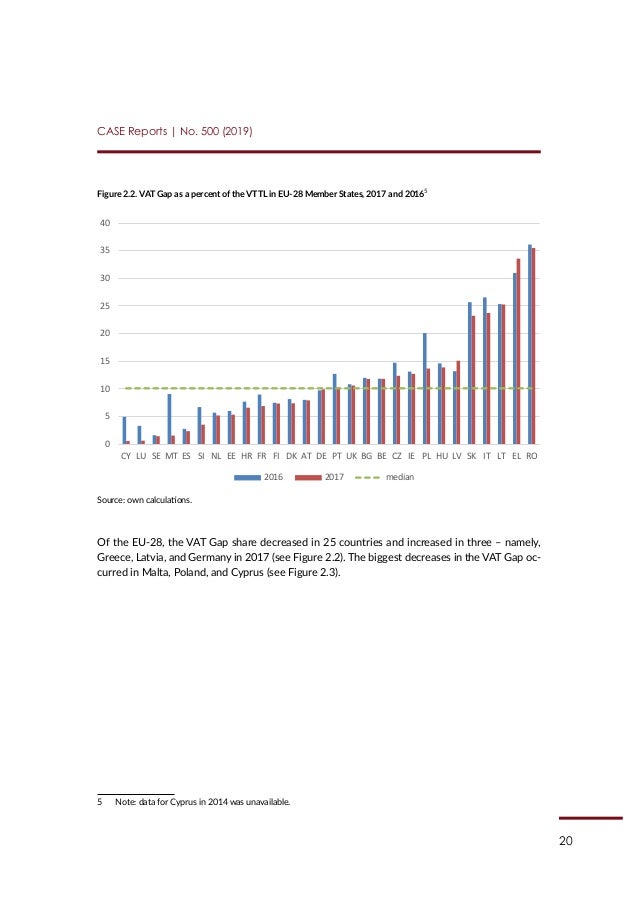

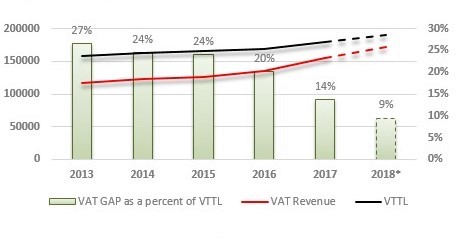

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

What is the Value-added tax (VAT) Gap and why is it important? - Invoicing compliance for online marketplaces

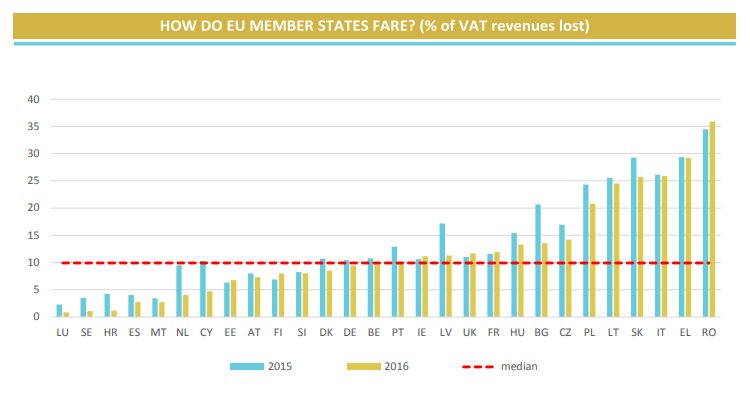

EU Tax & Customs 🇪🇺 on Twitter: "EU Member States still losing almost €150 billion in revenues according to new figures. Full VAT Gap report: https://t.co/LLdVPz9jv1 #VAT… https://t.co/pk3O6mF18I"

Before We Close Tax Gaps, We Have to Understand Them - CASE - Center for Social and Economic Research

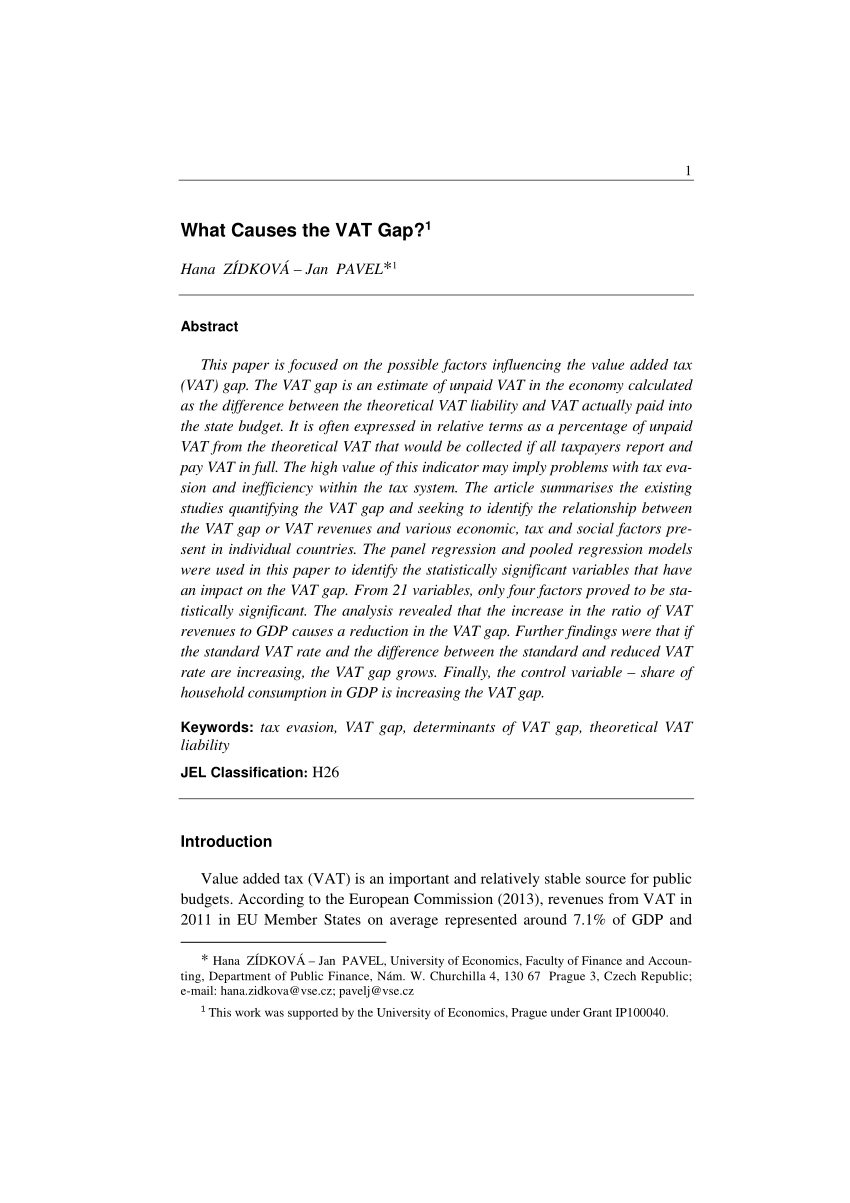

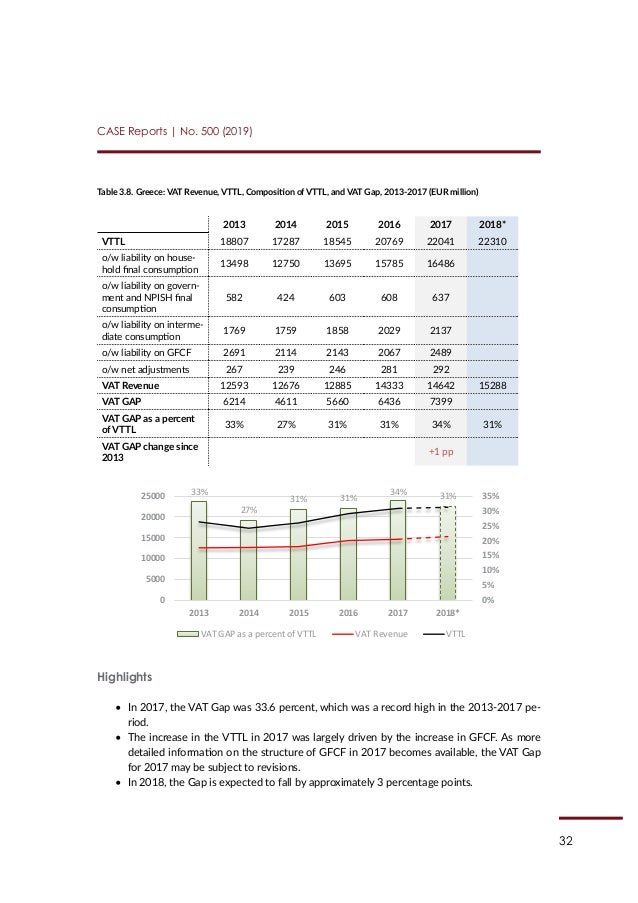

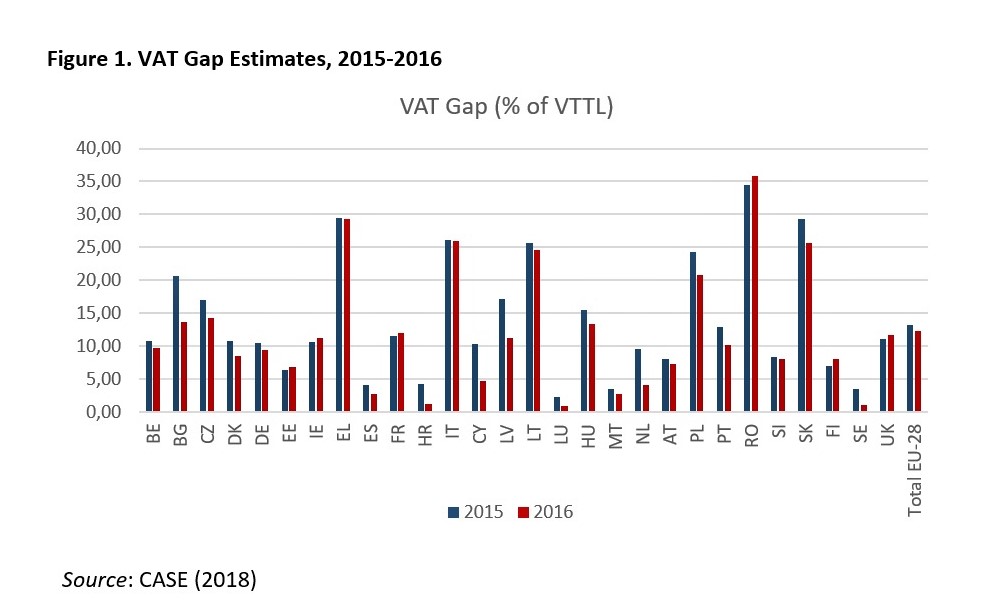

Study and Reports on the VAT Gap in the EU-28 Member States: 2017 Final Report | Value Added Tax | Taxes