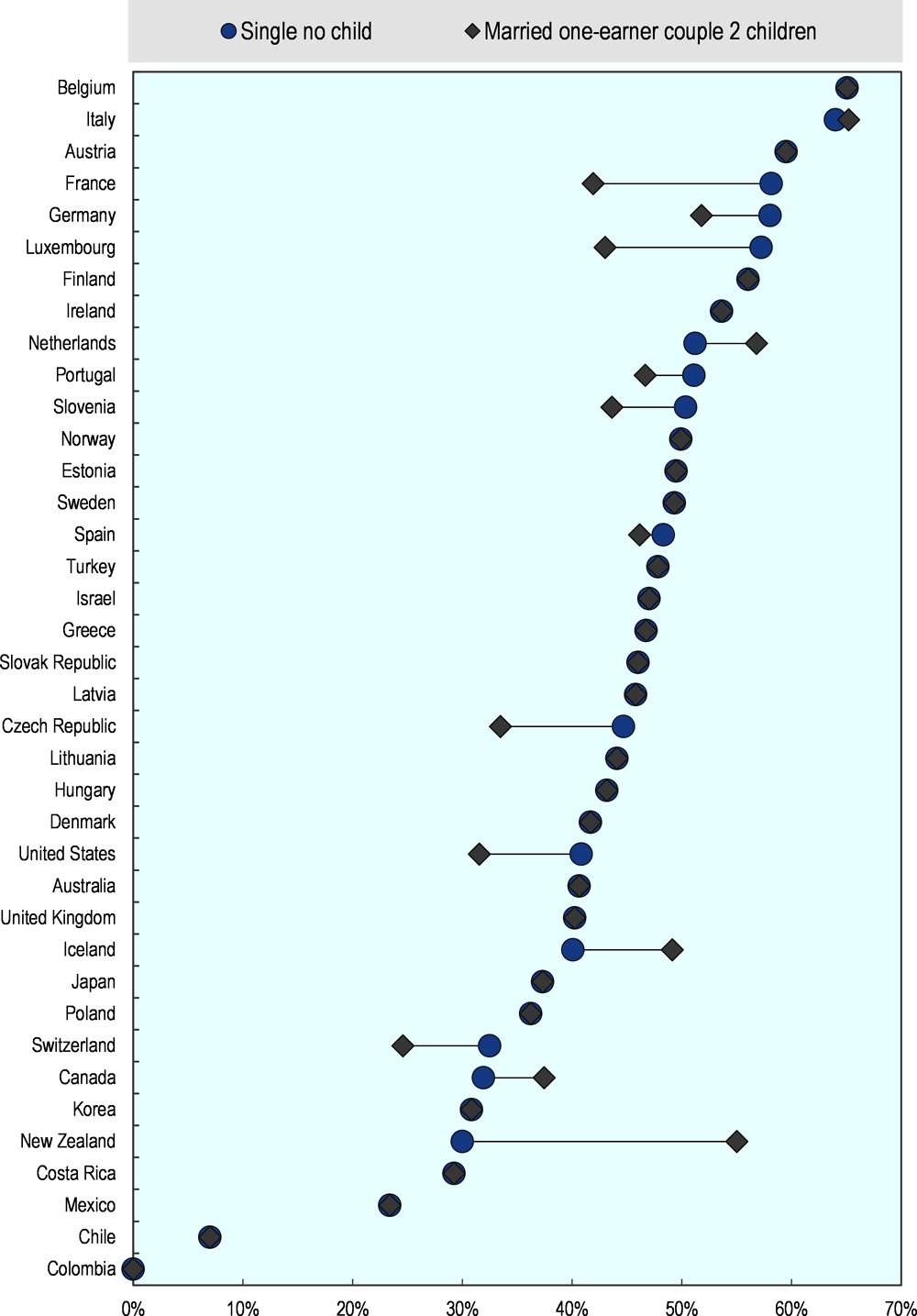

Top marginal tax rate on labor income, and marginal rate of income tax... | Download Scientific Diagram

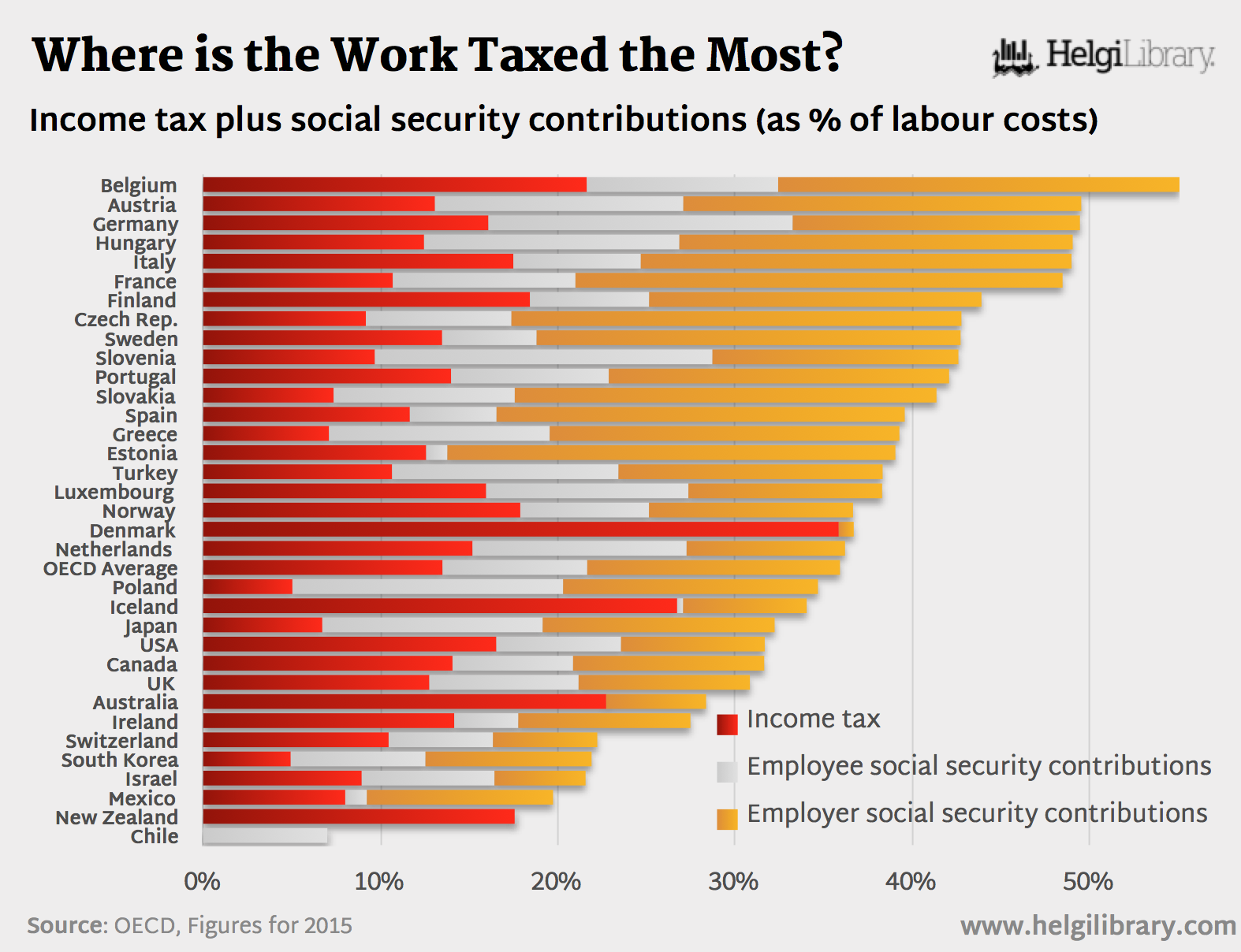

Income tax plus employee and employer social security contributions as % of labour costs in US, Britain, Germany, Italy, Canada, Australia, Sweden and Denmark | Utopia, you are standing in it!

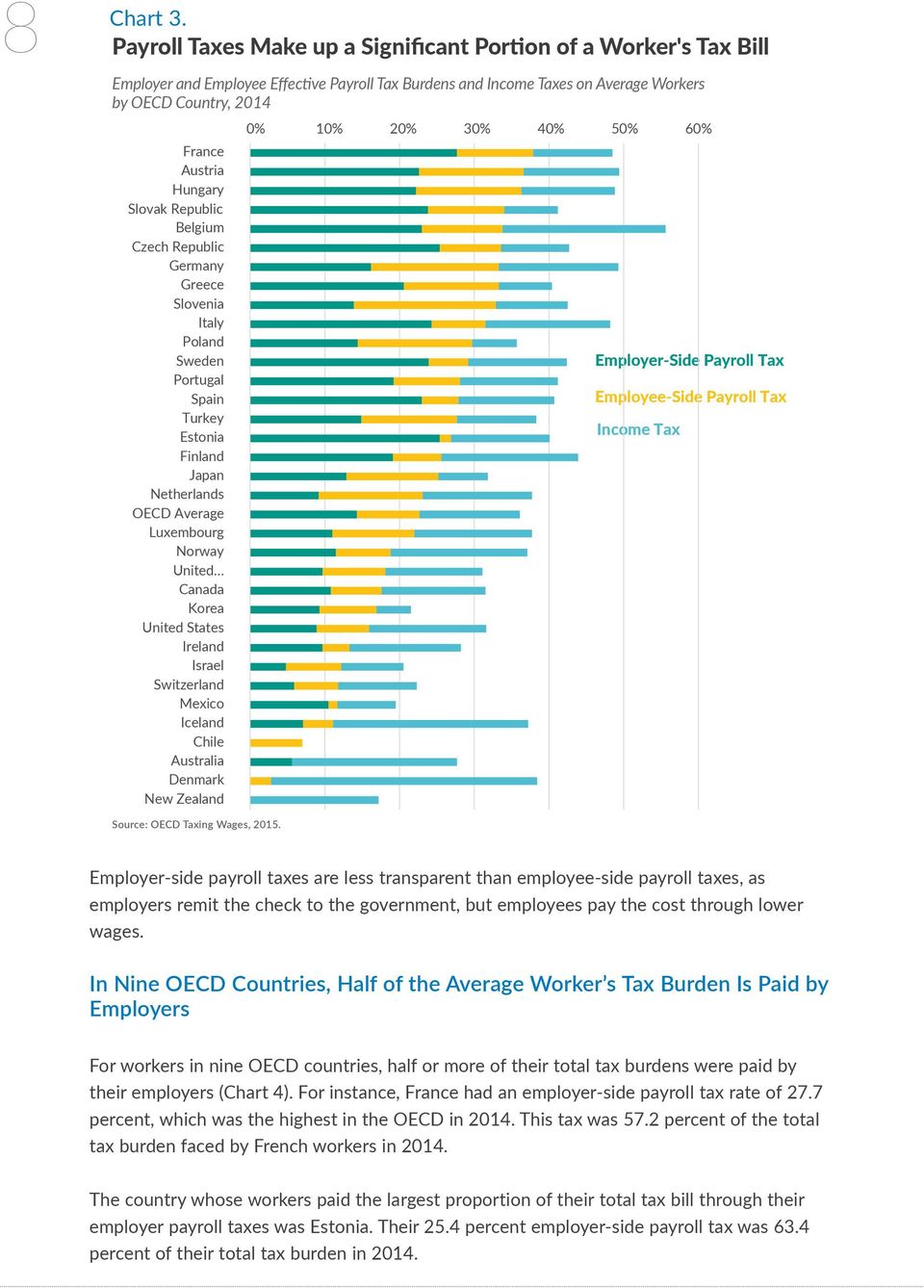

The estimated tax wedge in 2007 Income tax plus employer and employee... | Download Scientific Diagram

Institute for Fiscal Studies on Twitter: "The UK has lower average #tax rates on middle and high-income earners. An employee on median income – about £28,000 – faces an average tax rate (